I am done for the day

The important issues for retail traders are as follows

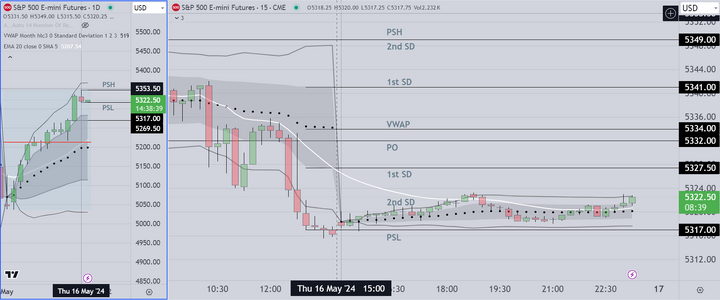

1) Select the time frame that works for you (15 min is recommended for retail)

2) Do your prep

a) Analysis of which setups worked best (and which failed) during the previous week

timing of entries is also part of the analysis. Once you document the times when

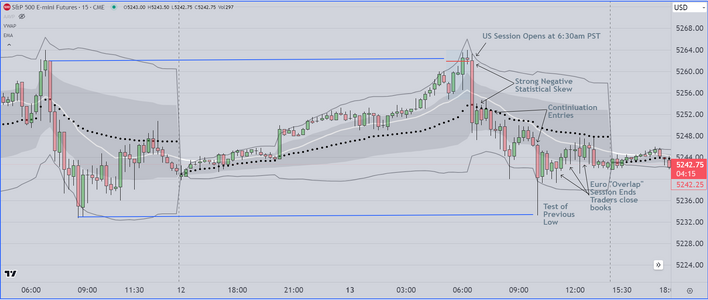

entries occur, you will start to see patterns, for example, in the S&P futures, it is common

to see trends move originate at or near 7am (PST/US time)

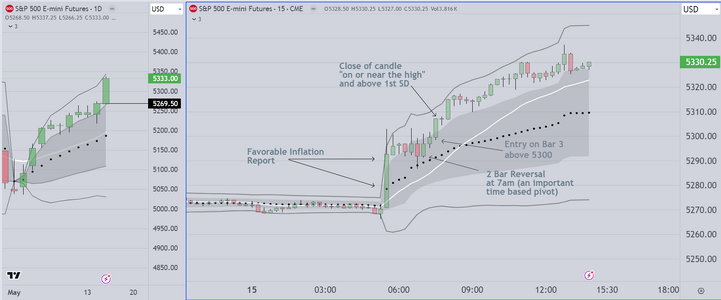

b) Timing of (high impact) economic reports (most important reports occur at 5:30am PST/USA time)

c) Create trading plane to include both long and short scenarios

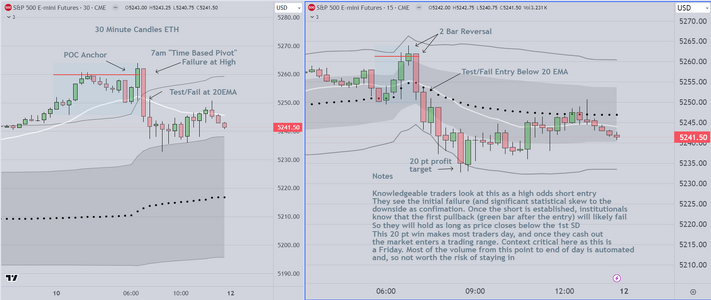

3) Review the previous sessions (ETH and RTH) prior to trading

Most of this is about discipline, and repetition is key to your success

At the open, prompt recognition of "day type" is critical. Generally I can identify the

type of day (trend or trading range) within the first 15 minutes). After that I adjust

my trading plan and wait for the right entry

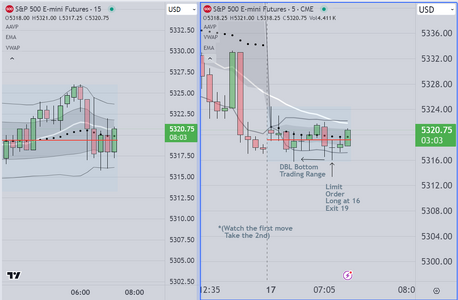

Attaching today's chart below

The important issues for retail traders are as follows

1) Select the time frame that works for you (15 min is recommended for retail)

2) Do your prep

a) Analysis of which setups worked best (and which failed) during the previous week

timing of entries is also part of the analysis. Once you document the times when

entries occur, you will start to see patterns, for example, in the S&P futures, it is common

to see trends move originate at or near 7am (PST/US time)

b) Timing of (high impact) economic reports (most important reports occur at 5:30am PST/USA time)

c) Create trading plane to include both long and short scenarios

3) Review the previous sessions (ETH and RTH) prior to trading

Most of this is about discipline, and repetition is key to your success

At the open, prompt recognition of "day type" is critical. Generally I can identify the

type of day (trend or trading range) within the first 15 minutes). After that I adjust

my trading plan and wait for the right entry

Attaching today's chart below

Attachments

Last edited: